spain: a true alternative for doing business after brexit

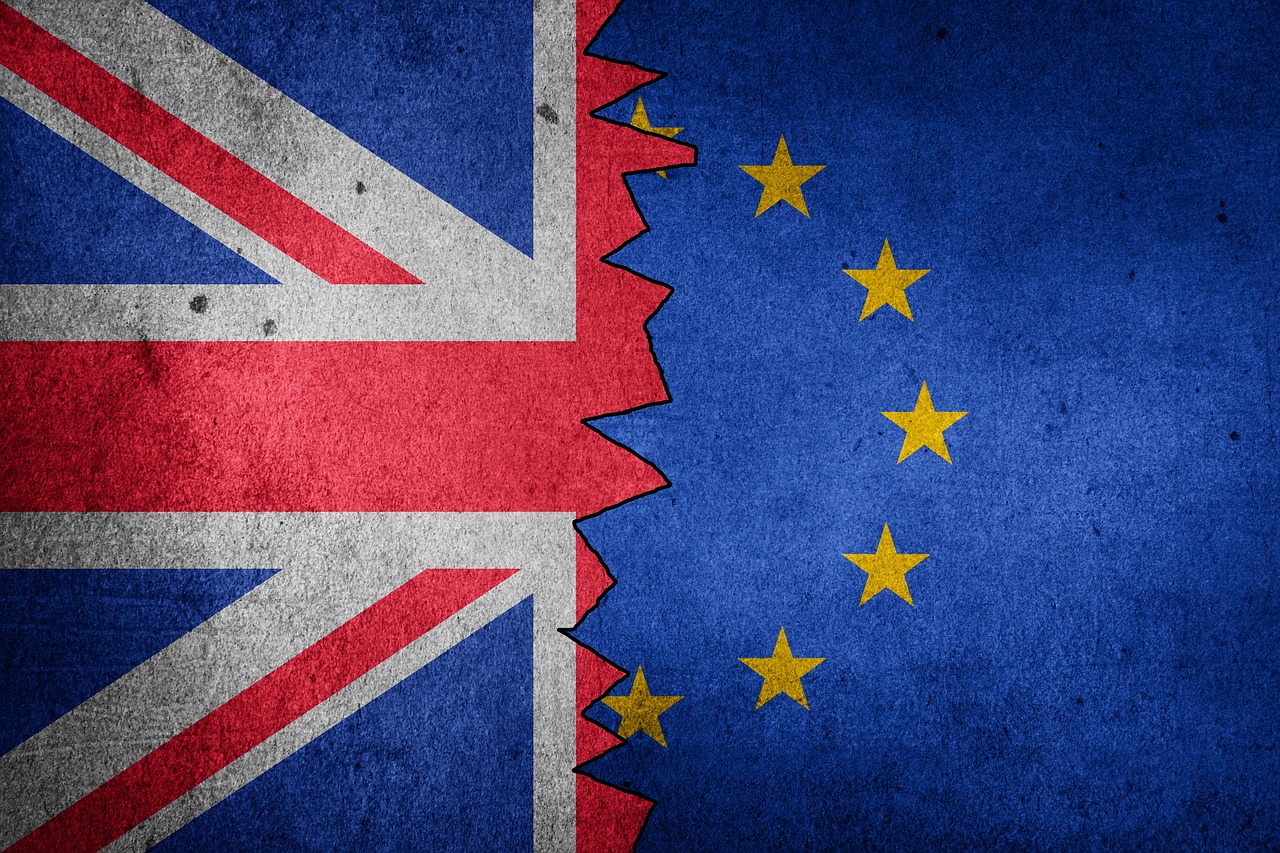

As per when Brexit becomes effective, many companies will relocate to other European countries to continue enjoying the freedom of movement guaranteed by EU law.

Advantages of choosing Spain:

-Economy growth at 3%; Spain is positioned as one of the countries with more room for improvement projection.

-Atractive workforce :Highly qualified workforce 25-30% cheaper tan average of Eurozone; flexible labour market; competitive employment and Social Security costs; easy obtaining work and residence permits; variety of employment contract …

-Competitive tax code for corporations: 25% tax rate (lower tan Germany or France); general participation exemption on dividends and capital gains deriving from qualifying stakes; net operation loses can be carried forward indefinetely up to 70% of the taxable base.

-For UK investors: Dividends distributed are exempt from Spanish withholding tax under the relevant UK-Spain DTC with a min. stake of 10%, as well an exemption of interest and capital gains from Spanish taxation.

As per all this advantages, Spain is a good place for those who wish to relocate their business, bearing in mind also the high life quality standards of cities like Barcelona or Madrid.